The Cost of Complacency

In 2021, the average claim for slip and fall injuries was nearly $50,000. This staggering amount highlights the need for vigilance and precaution during the winter months. By following these simple yet effective tips, you can prevent accidents and ensure the safety of yourself and others.

Footwear Matters

One of the first steps to prevent slips and falls is to choose the right footwear. Opt for shoes with wide, non-slip soles and deep treads. Avoid wearing heels, dress shoes, or any footwear that lacks proper traction. The right shoes can provide the stability you need on slippery surfaces.

Stay Alert to Changing Conditions

Winter weather can be unpredictable, with cycles of freezing, melting, and refreezing. Keep an eye on the weather forecast and be prepared for changing conditions. This awareness can help you anticipate and navigate slippery areas more safely.

Step Safely

When getting out of your vehicle or stepping off curbs, remember to step down, not out. Use your vehicle for added stability and step down with both feet to maintain balance. This simple change in habit can significantly reduce the risk of falls.

Follow Marked Pathways

Resist the temptation to take shortcuts. Marked pathways are often cleared and salted, providing the safest route of travel. By sticking to these paths, you can avoid unexpected icy patches.

Take Your Time

Speed is not your friend on ice and snow. Slow down and take small, careful steps to maintain your footing. Rushing can lead to slips and falls, so give yourself extra time to reach your destination.

Keep Your Hands Free

Try to carry only what is necessary and keep your hands free for balance. Use a backpack or bags to carry your belongings, and avoid overloading yourself.

The Penguin Shuffle

Embrace the penguin shuffle! Walk flat-footed and take short steps to keep your center of balance over your feet. This technique can help you maintain stability on icy surfaces.

Avoid Distractions

Put away your cell phone and focus on your surroundings while walking. Distractions can lead to accidents, so it's important to stay alert and aware of potential hazards.

Report and Act

If you spot icy conditions, report them to your employer or property owner so they can take action. Additionally, if salt is available, take the initiative to spread it on slippery areas to prevent accidents.

Stay Safe with R&R Insurance

At R&R Insurance, your safety is our priority. We hope these tips help you navigate the winter weather safely. For more information on this topic or any other services we provide, please don't hesitate to reach out to us. Stay safe and take care!

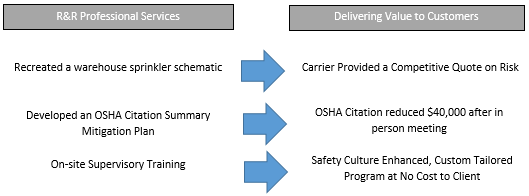

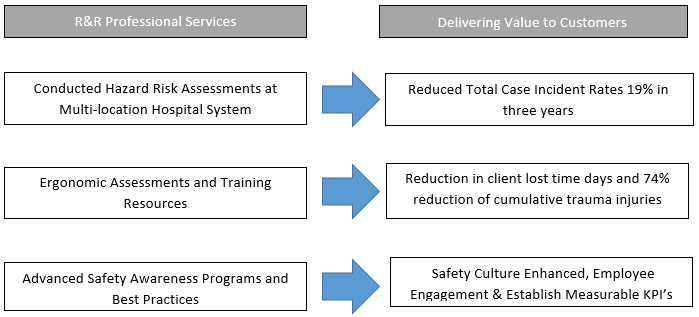

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.

To celebrate ladder safety month, now is the time to 1) review your ladder safety program, 2) conduct ladder safety training, and 3) test your ladder safety knowledge. The following outline provides an overview of using ladders properly.

To celebrate ladder safety month, now is the time to 1) review your ladder safety program, 2) conduct ladder safety training, and 3) test your ladder safety knowledge. The following outline provides an overview of using ladders properly. Effective October 16, 2018, OSHA launched a "Site-Specific Targeting (SST) inspection program". The goal of the program is to ensure that employers provide safe and healthful workplaces by directing enforcement resources to those workplaces with the highest rates of injuries and illness.

Effective October 16, 2018, OSHA launched a "Site-Specific Targeting (SST) inspection program". The goal of the program is to ensure that employers provide safe and healthful workplaces by directing enforcement resources to those workplaces with the highest rates of injuries and illness.  Many people are exposed to heat on the job, outdoors,

Many people are exposed to heat on the job, outdoors,  It's a topic no one wants to talk about. And everyone hopes will never happen to them. But the reality is that sometimes the unfortunate happens. Do you know what to do when an accident occurs that results in a death?

It's a topic no one wants to talk about. And everyone hopes will never happen to them. But the reality is that sometimes the unfortunate happens. Do you know what to do when an accident occurs that results in a death? Is your organization looking for a way to streamline the audit process for safety and compliance? Do you struggle to create and maintain audits, surveys or questionnaires?

Is your organization looking for a way to streamline the audit process for safety and compliance? Do you struggle to create and maintain audits, surveys or questionnaires?