Over the years, R&R Insurance has designed a proven 7-step method to successfully manage workers compensation programs. Our Professional Services have become experts in analyzing medical reserve dollars and can clearly articulate how insurance companies determine the numbers. By knowing market trends, carrier calculations, and your own unique situation, there are dollars to gain.

Over the years, R&R Insurance has designed a proven 7-step method to successfully manage workers compensation programs. Our Professional Services have become experts in analyzing medical reserve dollars and can clearly articulate how insurance companies determine the numbers. By knowing market trends, carrier calculations, and your own unique situation, there are dollars to gain.

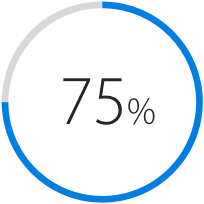

Wisconsin is one of the top 2 states in the country with the highest medical costs. Nearly 25 years ago, medical costs were 40% of work comp claims. Today, medical claims average 75% of total work comp claims. To put things into perspective, below are average rates based on five insurance carriers:

- Meniscus tear: $30,000 - $40,000

- Knee replacement: $60,000 - $100,000

- ACL repair: $45,000 - $55,000

This shift in costs can be directly correlated to several things:

- Healthcare uncertainty in last 10 years

- Affordable Care Act

- Shifting costs in workers compensation

- Lack of fee schedule in Wisconsin

- Diagnostics

- Actuarial pressures

So what can companies do to start minimizing medical only work comp claims? One of the more effective solutions is the integration of safety and wellness (or what R&R calls WellCompForLife). By cohesively utilizing these committees, companies are able to collectively share resources and ultimately reduce the total insurance spend. By creating a behavioral change, employees will remain healthy and money will be added back to the bottom line.

To learn more about R&R's proven model, contact a member of our Professional Services.

It's a topic no one wants to talk about. And everyone hopes will never happen to them. But the reality is that sometimes the unfortunate happens. Do you know what to do when an accident occurs that results in a death?

It's a topic no one wants to talk about. And everyone hopes will never happen to them. But the reality is that sometimes the unfortunate happens. Do you know what to do when an accident occurs that results in a death? Do you have employees who travel during their workday? Do you fully understand their exposures? Is it clear when they are driving within the course and scope of employment?

Do you have employees who travel during their workday? Do you fully understand their exposures? Is it clear when they are driving within the course and scope of employment?