WisconsinWorkers Compensation Rate Change October 1, 2025

Effective October 1, 2025, Wisconsin employers saw yet another overall rate decrease in workers' compensation. The overall rate reduction of 3.20% was notably less than reductions over the previous years, but still a reduction, nonetheless. This rate reduction marks the 10th consecutive year of a workers' compensation rate reduction for the state of Wisconsin. These reductions have been largely driven by wage growth, better than expected loss experience along with a reduction in claims frequency.

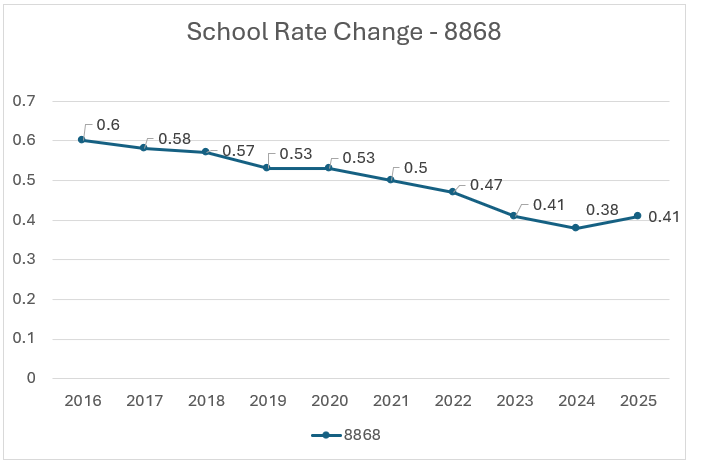

Looking specifically at schools, overall, they have benefited from the rate reductions in the past 10 years, but effective October of 2025 saw a notable rate increase. There are two main class codes in which associates employed by schools are assigned. Teachers and administrative staff would be attached to code 8868 (School: Professional Employees & Clerical). The rate in this code is down over 31% since 2016 as detailed in the chart below, but for 2025 it will see an increase of just under 8%.

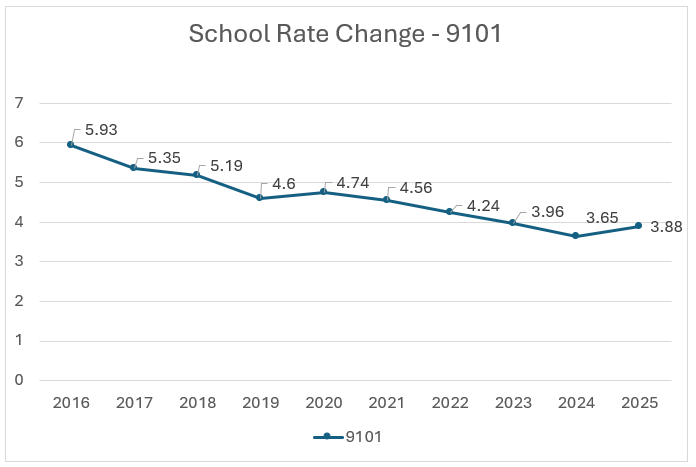

The other primary class code used by schools is 9101 (School: All Other Employees). This classification would include maintenance and custodial staff. Below you will find the rate change trend for this class which outlines an overall 34% reductionsince 2015. However, again for 2025 this class code will see a notable increase of over 6%.

After a Decade of Declines, Wisconsin School Workers’ Comp Rates Are Rising in 2025 and 2026.

Workers’ compensation premium is calculated by taking the payroll within a class code, multiplied by the corresponding rate and dividing by 100.

(Payroll* Rate) / 100 = Premium

(1,000,000 * 0.41) / 100 = $4,100

With the 2025 Wisconsin workers' compensation rate reduction far less significant than in years past it appears we could be approaching the end of the rate reduction trend. For 2025/2026 there are many notable classes including schools that are facing a rate increase for the first time in many years. This change in trend should come as a warning to all organizations they could be facing an increase in workers' compensation premiums in the months to come.

In an effort to control workers’ compensation premiums continued focus on overall risk management and experience modification management are critical to managing long-term costs. R&R Insurance has a great track record of working with clients closely to educate them on the nuances of the workers’ compensation system.

See the Wisconsin School Risk & Safety Scorecard to find out how well your district rates.

Should you have any questions regarding the rate changes effective October 1st, 2025, please reachout to R&R Insurance for additional information. We be happy to walk you through these changes in more detail and outline how they will impact your school district.