Effective loss control begins with our experienced knowledge. R&R Insurance offers services to effectively lower the potential risk in your workplace and in your business practices. Our dedicated Resource Team does not believe in a "one size fits all" approach regarding Loss Control services. We will review your loss experience, safety programs, and management commitment and accountability. We'll then partner with you and your insurance carrier to provide "High Impact" loss control activities focused on reducing your costs by reducing claims.

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.

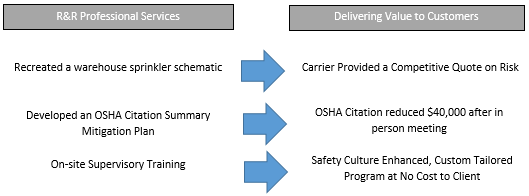

John carries with him a portfolio of skills and experience that are unmatched. Below is a listing of some recent engagements where John has created value for R&R Insurance clients:

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been Maureen Joy’s focus for the last 11 years at R&R Insurance. Maureen’s strength is interacting and partnering with R&R clients in the facilities where they work, or these days, providing her loss prevention programs virtually, for our clients.

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been Maureen Joy’s focus for the last 11 years at R&R Insurance. Maureen’s strength is interacting and partnering with R&R clients in the facilities where they work, or these days, providing her loss prevention programs virtually, for our clients.

Maureen has delivered custom training programs and educated thousands of our clients' employees during her career. As a licensed Occupational Therapist, Maureen is a skilled trainer and experienced presenter using a client-centered, interactive approach.

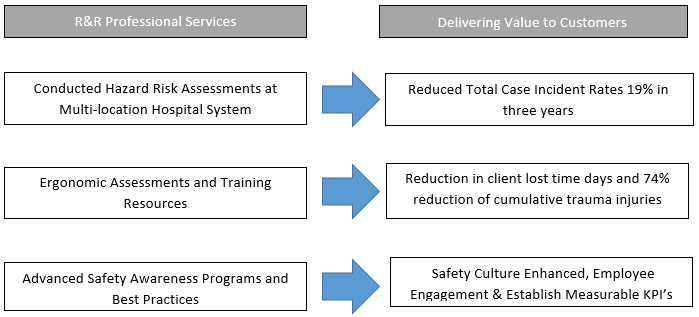

Maureen’s combination of loss prevention knowledge, coupled with her medical background and training, makes her a unique resource for R&R Insurance clients. Below is a listing of some recent engagements where Maureen has created value for R&R Insurance clients:

For more information on R&R Professional Services, visit https://www.myknowledgebroker.com/business-insurance/risk-management.