- Home

- Business Insurance

- Industries

- Agriculture & Agribusiness

- Arts, Entertainment, & Recreation

- Auto and Franchise Dealers

- Camps and Retreats

- Child Care

- Construction

- Dental Practice

- Financial and Professional Services

- Fitness

- Food & Beverage

- Gas & Oil Distribution

- Healthcare & Social Services

- Hospitality, Media and Entertainment

- Lumber / Wood Products

- Manufacturing and Industrial Services

- Public and Private Education

- Public Entity / Municipalities

- Real Estate

- Retail

- Small Business

- Technology & Cyber Security

- Temporary Staffing

- Tree Care & Arborists

- Trucking, Transportation, & Warehousing

- Veterinarian & Animal Care

- Benefits

- Financial Services

- Bonds

- Personal Insurance

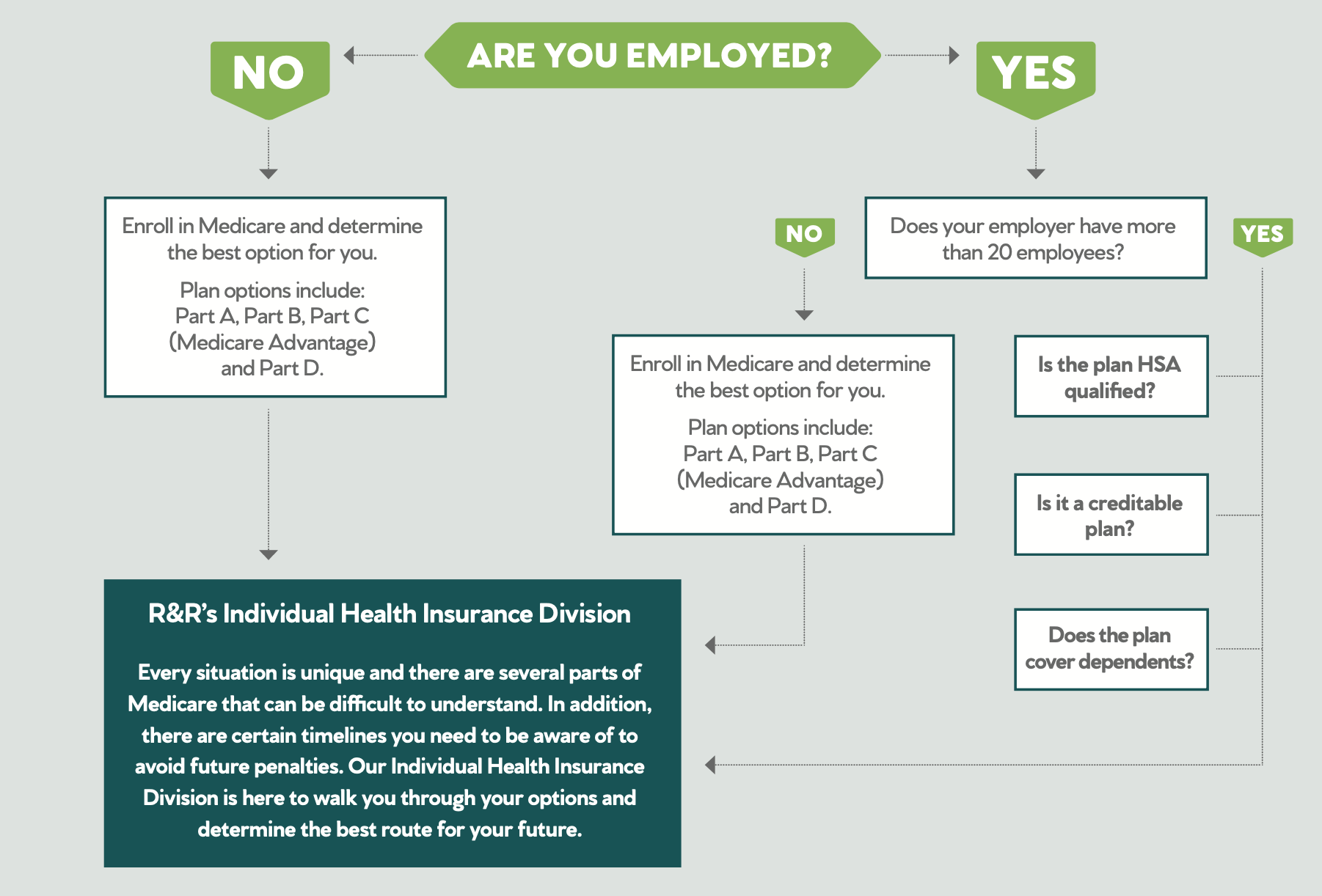

- Medicare

- Resources

- About Us

- Careers

- Blog

- Employee Directory

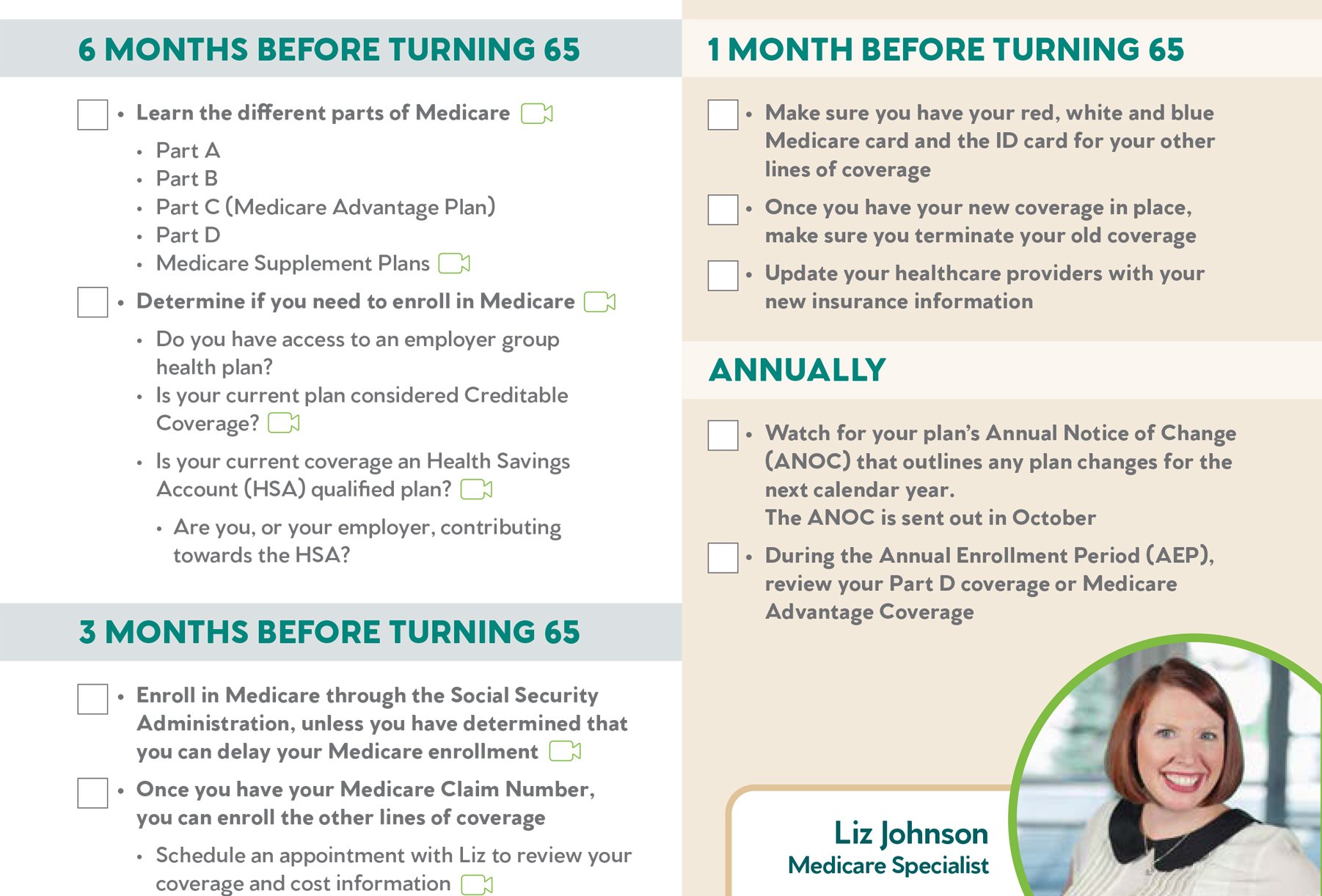

If you would like to evaluate your Medicare options, or know someone who does, contact R&R’s own Medicare Benefits Specialist, Liz Johnson, for a complimentary consultation.

If you would like to evaluate your Medicare options, or know someone who does, contact R&R’s own Medicare Benefits Specialist, Liz Johnson, for a complimentary consultation.