On January 7, 2021, the Equal Employment Opportunity Commission (EEOC) released two long-awaited proposed rules on wellness programs under the Americans with Disabilities Act (ADA) and the Genetic Information Non- Discrimination Act (GINA). These Notices of Proposed Rulemakings (NPRM) have been cleared by the Office of Management and Budget and sent to the Federal Register for publication and public comment.

Back in October of 2016, the American Association of Retired Persons (AARP) sued the EEOC on the grounds that the EEOC’s wellness rules incentive at the time of 30% was too high a penalty for nonparticipating workers – and therefore could not be considered as “voluntary”. In December of 2018, a federal judge ruled that the EEOC failed to justify its 30% cap on cost incentives for participating in a wellness program and as a result, effective January 1, 2019, vacated the incentive limit. Employers have been waiting ever since for further guidance as to permissible incentive limits.

The EEOC’s Latest Proposed Wellness Rules

What Has Been Proposed?

The

proposed ADA wellness rule imposes a

“de minimis” incentive limit for most wellness programs that include disability-related inquiries (e.g. a health risk questionnaire) and/or medical examinations (e.g. a biometric screening).

- An employer may not offer more than a “de minimis” incentive (such as a water bottle or gift card of modest value) in exchange for an employee participating in the wellness program.

- There is an exception if the program is a “health-contingent wellness program”(subject to HIPAA’s rules and incentive limits).

- Example: If the wellness incentive is conditioned on biometric screening results meeting health-contingent outcomes (such as having cholesterol or BMI within a certain range or improving a certain percentage compared to the prior year’s screening), then it must still comply with the ADA as a medical exam but can offer more than a “de minimis” incentive due (subject to HIPAA’s rules and incentive limits).

While health contingent programs have fallen out of popularity throughout the years, these proposed rules, if approved, suggest that wellness vendors would need to make changes to guarantee EEOC compliance to their wellness programming.

The proposed GINA wellness rule likewise “would limit wellness programs to offer a “de minimis” incentive to all family members, not just spouses, in exchange for family members providing information about their manifestation of diseases or disorders.

The proposed rule also continues to prohibit any incentive tied to employees answering questions about their own genetic information. However, there is a small exception allowing a “de minimis” incentive in exchange for family members (including spouses) responding to inquiries about their own manifestation of diseases or disorders.

What is de minimis?

The proposed rules are significantly different from the previous rules regarding wellness incentive limits. The guidance provides that a “de minimis” limit permits only nominal incentives such as a water bottle or a gift card of modest value. The proposed rules also state that a $50/month medical premium surcharge, reimbursement of annual gym membership fees, or free airline tickets would not be considered “de minimis.” Hopefully, further clarification on what will meet the definition of “de minimis” for these purposes will be provided in the final rule.

What’s Next?

These Notices of Proposed Rulemakings (NPRM) have been cleared by the Office of Management and Budget and sent to the Federal Register for publication and public comment. It is important to note that these NPRMs have not been finalized and may not be relied upon.

Comments on the NPRMs are due 60 days after they are published in the Federal Register – which as of the date of this article has not yet occurred. Once the NPRMs have been published on the Federal Register, employers having concerns about how these rules may impact their wellness programs are encouraged to take advantage of the 60-day public comment period. Members of the public will be able to submit electronic comments about the proposed rules at www.regulations.gov in the rulemaking dockets RIN 3046-AB10 and RIN 3046-AB11.

With a new Presidential Administration upon us, it is unclear what impact that may have on these proposed rules. Currently, Republican appointees hold a 3-2 edge at the EEOC until at least July 2022. There is some speculation that the new Administration may put these new rules on hold until post July 2022 or that they may change certain aspects of the final rule when issued, depending on the comments the EEOC receives. At this point, we do not know what impact this may have on moving this forward.

R&R will continue to monitor regulatory guidance and offer meaningful, practical, timely information to you. We welcome the opportunity to eventually discuss what type of wellness program and incentives will best promote good health for your employees and comply with ADA and GINA requirements once finalized.

Resources:

EEOC Proposed Rule for ADA - Proposed Rule - Amendments to Regulations Under the Americans With Disabilities Act | U.S. Equal Employment Opportunity Commission (eeoc.gov)

EEOC Proposed Rule for GINA - Proposed Rule - Amendments to Regulations Under the Genetic Information Nondiscrimination Act of 2008 | U.S. Equal Employment Opportunity Commission (eeoc.gov)

February is recognized as American Heart Health Month. Your heart is one of the hardest-working muscles in your body and all of that work can take a toll. Not treating your body right can escalate your risk for serious health issues, like heart disease.

February is recognized as American Heart Health Month. Your heart is one of the hardest-working muscles in your body and all of that work can take a toll. Not treating your body right can escalate your risk for serious health issues, like heart disease.

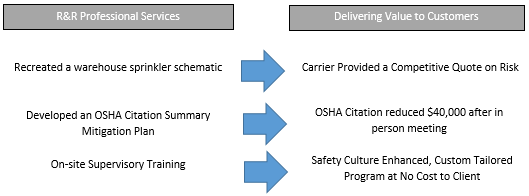

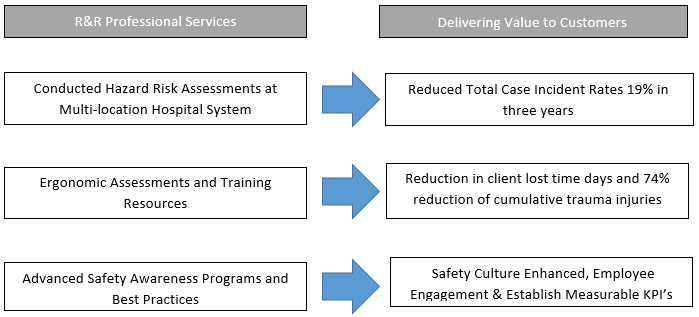

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.

Helping customers design effective loss prevention programs and providing safety consulting services for R&R clients has been John Brengosz’s focus for the last 15 years at R&R Insurance. John has trained and educated thousands of employees during his career. John is a skilled teacher and presenter during these programs as well.