According to Enrich.org, "A Northwestern Mutual study found that 44 percent of Americans stated that financial concerns were their number one stressor, with more than one in four feeling depressed about finances at least monthly and two out of ten feeling depressed weekly, daily, or hourly."

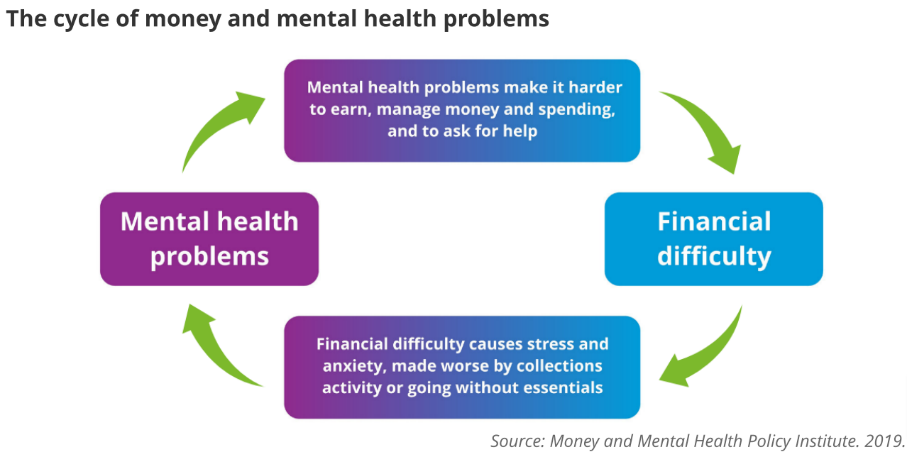

Whether it be the swipe of a card, or the handing over of a paper bill, people are impacted by finances daily. The toll is not just on one's bank account. Larger effects include physical and mental health symptoms, negative implications within the workplace, and developing a vicious cycle that furthers these negative effects.

According to WebMD, "if your financial wellness is low and you have high financial stress, you're twice as likely to have poor overall health. Experts found that you're four times as likely to get some sort of condition."

| Effects on Physical Health | Effects on Mental Health |

|

|

A Money and Mental Health survey of nearly 5,500 people with mental health problems found that, while unwell:

- 93% spent more than usual

- 92% found it harder to make financial decisions

- 74% put off playing bills

- 71% avoided dealing with creditors

- 56% took out a loan that they would not otherwise have taken out

Tips to gain better financial wellbeing, according to HelpGuide.org:

https://www.helpguide.org/articles/stress/coping-with-financial-stress.htm

- Tip 1: Talk to someone

- Get professional advice

- Open up to friends and family

- Tip 2: Take inventory of your finances

- Include every source of income

- Keep track of ALL your spending

- List your debts

- Identify your spending patterns and triggers

- Look to make small changes

- Eliminate impulse spending

- Go easy on yourself

- Tip 3: Make a plan – and stick to it

- Devise a solution

- Put your plan into action

- Monitor your progress

- Don't get derailed by setbacks

- Tip 4: Create a monthly budget

- Include everyday expenses in your budget

- i.e. groceries, gas, rent/mortgage, utilities, clothes, etc.

- Remember annual expenses

- i.e. car insurance, property taxes, etc.

- Unexpected/Variable expenses

- i.e. medical expenses, car repairs, etc.

- Prioritize your spending

- pay the necessities first, such as covering the electrical bill and buying groceries. After those are covered, figure out where the rest can go, such as debt payments, entertainment, etc.

- Start an emergency fund

- start building up to one month's income

- Enlist support from your spouse, partner, kids

- Include everyday expenses in your budget

- Tip 5: Manage your overall stress

- Exercise

- Practice relaxation techniques like meditation and yoga

- Improve your sleep

- Eat a balanced diet

- Boost your self-esteem

- Practice gratitude