Case Study: An Underinsured Home

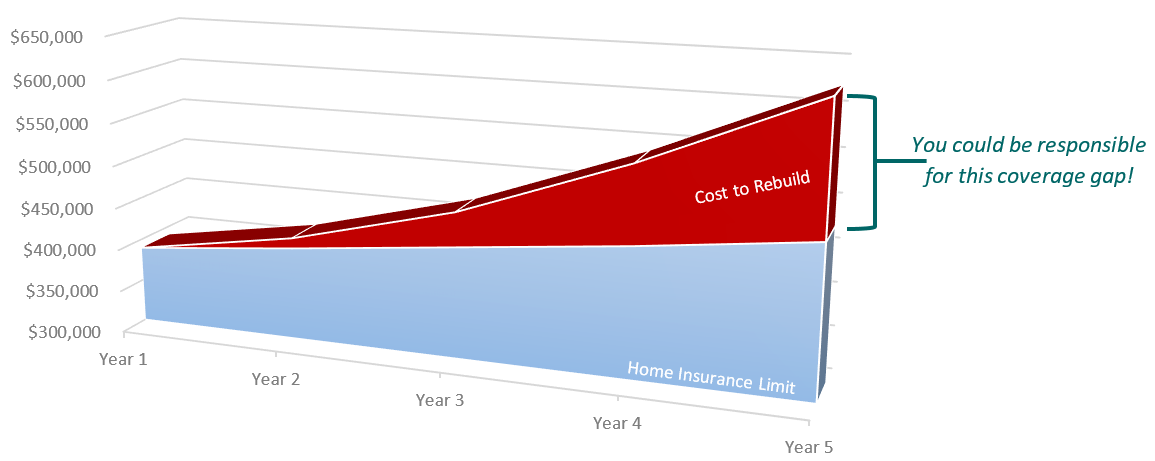

The Dwelling Limit on your Homeowners Insurance policy is critical in the event of a serious claim. We'll use the following numbers as an example:

Home Purchase Price: $575,000

Home Insurance Limit: $475,000

Cost to Rebuild in 2022: $625,000

If this home was severely damaged in a catastrophe - fire, tornado, explosion, etc. - it would be considered grossly underinsured.

The insurance company would be responsible for the removal of damaged debris, site preparation, and the process of rebuilding the home from the ground up with the same construction quality and design as the previous home. They will only cover the cost of each these items combined up to the Dwelling Limit.

In this scenario, the Homeowners would be responsible for $150,000 in out-of-pocket expense costs! This could be catastrophic for the average family, especially when their Dwelling Limit could be increased for a nominal overall cost.